Using a Domain-Specific Language for Financial Engineering

by Arie van Deursen

In order to reduce the lead time to market for new types of financial

products, it is crucial that a bank’s financial and management

information systems can be quickly adapted. The use of domain-specific

languages has proved a valuable tool to achieve this required

flexibility.

Financial engineering deals, amongst others, with interest rate

products. These products are typically used for inter-bank trade,

or to finance company take-overs involving triple comma figures

in multiple currencies. Crucial for such transactions are the

protection against and the well-timed exploitation of risks coming

with interest rate or currency exchange rate fluctuations.

The simplest interest rate product is the loan: a fixed amount

in a certain currency is borrowed for a fixed period at a given

interest rate. More complicated products, such as the financial

future, the forward rate agreement, or the capped floater, all

aim at risk reallocation. Banks frequently invent new ways to

achieve this, giving rise to more and more interest rate products.

This, however, affects the bank’s automated systems, which perform

contract administration and provide management information concerning

the bank’s on- and off-balance position, interest and exchange

rate risks, etc.

To make the required modifications to these systems, bank MeesPierson

and software house CAP Gemini decided to describe the essence

of their interest rate products in a high-level language, and

to generate the software automatically from these product descriptions.

To that end, a small domain-specific language was designed, especially

suited to describe so-called cash-flows following from products.

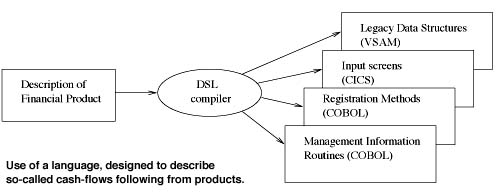

The use of this language is illustrated in the Figure. At the

heart of the system is a compiler for the domain-specific language.

Given a high-level product description, it is able to generate

automatically data structures in VSAM format, data entry screens

in CICS format, and COBOL routines for registering modifications

in the product or for yielding management information.

The key enabler to the compiler is a COBOL library formalizing

domain concepts such as cash flows, intervals, interest payment

schemes, date manipulations, etc. The domain-specific language

provides ways to combine these concepts into products, using a

notation that is familiar to financial engineers. The language

has been developed in collaboration with CWI, using the ASF+SDF

Meta-Environment to construct a prototype tool suite.

The language has been included in Cap Gemini’s Financial Product

System FPS, which is in use at several Dutch financial institutions.

Time to market has gone down from months to days, and IT cost

reductions of up to 50% have been reported.

At the time of writing, CWI is involved in a major research project

addressing the tooling, application, and methodology of domain-specific

languages in general – a project that is carried out as part of

the Dutch Telematics Institute, in collaboration with several

Dutch businesses.

Please contact:

Arie van Deursen - CWI

Tel: +31 20 592 4075

E-mail: arie@cwi.nl