Numerical Algorithms Group

by David Sayers

Numerical Algorithms Group Ltd (NAGTM), a not-for-profit software

house, is the UK’s leading producer and supplier of mathematical

computer software for business, education and industry. A key

focus and growth area is the complex world of finance. Here, according

to NAG technical consultant David Sayers, the role that his company’s

technology could play in delivering competitive advantage is tantalisingly

ripe for discovery.

NAG was founded in an academic research environment. It was created

in 1970 by numerical analysts co-ordinated from the University

of Nottingham, moved to Oxford in 1973, then expanded to become

an international group. Today NAG continues to be driven by a

network of research professionals from around the world. Its successes

to date have always depended on integrating this world effectively

with that of the ‘real’ world as experienced by the end users

of its technology. Nag is committed to secure future successes

by adopting the same approach. For example, there is little point

forging ahead with research to heighten accuracy, when customers

have a more pressing need for speed of delivery. NAG has recently

launched a proactive initiative to investigate the financial customer

base in more detail, to direct its research network to deal more

closely with the real life problems financial analysts have to

solve today....and tomorrow.

NAG’s numerical libraries are already used extensively in financial

institutions around the world, here NAG is prized for the high

quality, reliability and speed of its software, scope (in terms

of the range of solutions available) and attentive level of technical

support. The customer base is wide ranging, some users work on

the smallest PC while others manage the most modern supercomputers;

they use a variety of computing languages. A key requirement these

institutions have in common is the need to use NAG routines to

develop unique in-house trading and pricing strategies, something

that is not possible with off-the-shelf complete packages.

For those with particularly complex financial challenges, NAG

also offers a consultancy service. Recent work, for example, involved

a sophisticated portfolio tracking program and the provision of

a bespoke module for trading in global currency and bond markets.

The same NAG mathematical consultants are constantly considering

general trends in the marketplace to direct software development.

Key trends already identified include interest in the single European

currency. NAG has already predicted a refinement in investment

strategies based on a much larger global portfolio of shares than

at present in Europe. The indices will now cross the European

spectrum of shares not just those quoted on the local exchanges.

Problem sizes will be larger, leading to a greater demand for

more powerful routines capable of solving larger problems. Here

NAG’s multi-processor libraries (SMP and Parallel libraries) are

the ideal solution.

Another interesting development under scrutiny is the inclusion

of transaction costs in portfolio modelling. This leads to the

minimisation of numerically difficult discontinuous functions.

Accordingly, major software systems will need to rely on NAG’s

expertise and quality to solve complex problems.

Derivatives are also becoming more complex – with simple option

pricing giving way to the more complicated problem of pricing

exotic derivatives. Black-Scholes models are now starting to give

way to more sophisticated models.

As European markets change, so will the regulatory bodies and

surrounding legislation. Dealers will need to know how their books

stand at the end of the day, to meet both the regulatory requirements

and the ‘risk of exposure’ requirements of their own managers.

With NAG’s flexible solvers, the adaptation to changing circumstances

is made possible. NAG is also already anticipating new breeds

of programmers graduating from universities. These people are

moving away from the traditional library approach to problem solving.

They will need either more sophisticated components or solution

modules that interface to ‘packages’ or ‘problem solving environments’.

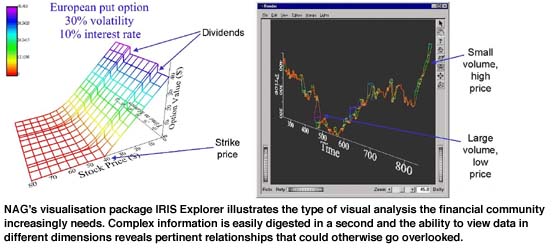

Users will have ever increasing amounts of data to analyse and

assess. This will require good visualisation capabilities and

a system capable of performing meaningful and powerful statistical

analysis of that data.

Looking ahead, NAG is committed to meeting financial analysts’

need for speedier, accurate solutions by enhancing the numerical

libraries that have already gained a considerable following in

this community. The company will also deliver the security and

flexibility these customers require. As architectures change,

so the libraries will change to fully exploit new features and

to embrace the increasing need for thread-safety. At the same

time, NAG will enhance the libraries with newer and more powerful

solvers, keeping pace with the rapid advances in numerical techniques.

In addition, further work will focus on presenting NAG’s numerical

techniques in new ways, ensuring the power of this technology

can be accessed by news types of user.

NAG also anticipates a surge in awareness of the competitive advantage

of using visualisation packages, again a key area for the new

types of user. NAG’s own package, IRIS Explorer(tm) can be combined

with the reliable engines of the company’s libraries to form a

bespoke computational and visualisation program. This is a vital

development in the financial world where, for example, dealers

are under pressure to absorb the results of a calculation at a

glance. Numbers are not sufficient. NAG is set to develop more

visualisation modules to meet the expected demand for increasingly

more powerful tools in this area.

Further focus areas and challenges will doubtless emerge. NAG

anticipates with relish that the rate of change and pace of software

development will be phenomenal. For more information on NAG, see

http://www.nag.co.uk.

Please contact:

David Sayers - NAG Ltd

Tel: +44 186 551 1245

E-mail: david@denham.nag.co.uk