ShowRisk - Prediction of Credit Risk

by Gerhard Paaß

The growing number of insolvencies as well as the intensified

international competition calls for reliable procedures to evaluate

the credit risk (risk of insolvency) of bank loans. GMD has developed

a methodology that improves the current approaches in a decisive

aspect: the explicit characterization of the predictive uncertainty

for each new case. The resulting procedure does not only derive

a single number as result, but also describes the uncertainty

of this number.

Credit Scoring procedures use a representative sample to estimate

the credit risk, the probability that a borrower will not repay

the credit. If all borrowers had the same features, the credit

risk may be estimated. Therefore the uncertainty of the estimate

is reduced if the number of sample elements grows. In the general

case complex models (eg neural networks or classification trees)

are required to capture the relation between the features of the

borrowers and the credit risk. Most current procedures are not

capable to estimate the uncertainty of the predicted credit risk.

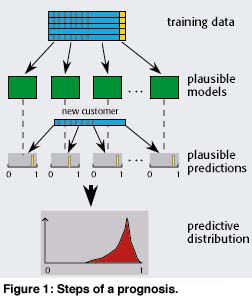

Prediction with Plausible Models

We employ the Bayesian theory to generate a representative selection

of models describing the uncertainty. For each model a prediction

is performed which yields a distribution of plausible predictions.

As each model represents another possible relation between inputs

and outputs, all these possibilities are taken into account in

the joint prediction.

A theoretical derivation shows that the average of these plausible

predictions in general has a lower error than single ‘optimal’

predictions. This was confirmed by an empirical investigation:

For a real data base of several thousand enterprises with more

than 70 balance sheet variables, the GMD procedure only rejected

35.5% of the ‘good’ loans, whereas other methods (neural networks,

fuzzy pattern classification, etc.) rejected at least 40%.

Expected Profit as Criterion

The criterion for accepting a credit is a loss function specifying

the gain or loss in case of solvency/insolvency. Using the predicted

credit risk we may estimate the average or expected profit. According

to statistical decision theory a credit application should be

accepted if this expected profit is positive. Depending on the

credit conditions (interest rate, securities) this defines a decision

threshold for the expected profit.

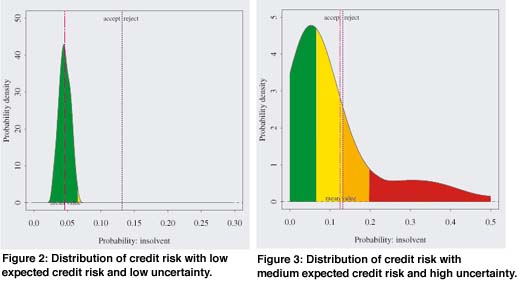

In figures 2 and 3 the decision threshold for a credit condition

is depicted: If the predicted average credit risk is above the

threshold, a loss is to be expected on average and the loan application

should be rejected. Figure 2 shows a predictive distribution where

the expected credit risk is low. The uncertainty about the credit

risk is low, too, and the loan application could be accepted without

further investigations. The expected credit risk of the predictive

distribution in figure 3 is close to the decision threshold.

The actual credit risk could be located in the favourable region

the intermediate range or in the adverse region. The information

in the training data are not sufficient to assign the credit risk

to one of the regions. Obviously the data base contains too few

similar cases for this prediction resulting in an uncertain prediction.

Therefore in this case there is a large chance that additional

information, especially a closer audit of the customer, yields

a favorable credit risk.

Application

Under a contract the credit scoring procedure was adapted to the

data of the German banking group Deutscher Sparkassen und Giroverband

and is currently in a test phase. For each new application it

is possible to modify the credit conditions (interest rate, securities)

to find the conditions, where the credit on the average will yield

a profit. For a prediction the computing times are about a second.

Currently an explanation module is developed which will explain

the customer and the bank officer in terms of plausible rules

and concepts, why the procedure generated a specific prediction.

Please contact:

Gerhard Paaß - GMD

Tel: +49 2241 14 2698

E-mail: paass@gmd.de