Genetic Programming for Feature Extraction in Financial Forecasting

by József Hornyák and László Monostori

Artificial neural networks (ANNs) received great attention in

the past few years because they were able to solve several difficult

problems with complex, irrelevant, noisy or partial information,

and problems which were hardly manageable in other ways. The usual

inputs of ANNs are the time-series themselves or their simple

descendants, such as differences, moving averages or standard

deviations. The applicability of genetic programming for feature

extraction is investigated at the SZTAKI, as part of a PhD work.

During the training phase ANNs try to learn associations between

the inputs and the expected outputs. Although back propagation

(BP) ANNs are appropriate for non-linear mapping, they cannot

easily realise certain mathematical relationships. On the one

hand, appropriate feature extraction techniques can simplify the

mapping task, on the other hand, they can enhance the speed and

effectiveness of learning. On the base of previous experience,

the user usually defines a large number of features, and automatic

feature selection methods (eg based on statistical measures) are

applied to reduce the feature size. A different technique for

feature creation is the genetic programming (GP) approach. Genetic

programming provides a way to search the space of all possible

functions composed of certain terminals and primitive functions

to find a function that satisfies the initial conditions.

The measurement of goodness of individual features or feature

sets plays a significant role in all kinds of feature extraction

techniques. Methods can be distinguished, whether the learning/

classification/estimation phases are incorporated in the feature

extraction method (filter and wrapper approaches).

In fact, most of the financial technical indicators (Average True

Range, Chaikin Oscillator, Demand Index, Directional Movement

Index, Relative Strength Index etc.) are features of time-series

in a certain sense. Feature extraction can lead to similar indicators.

An interesting question is, however, whether such an approach

can create new, better indicators.

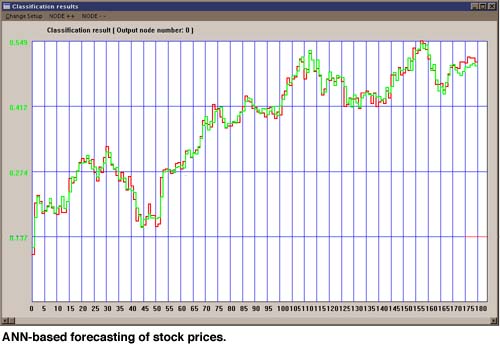

The techniques were demonstrated and compared on the problem of

predicting the direction of changes in the next week’s average

of daily closes for S&P 500 Index. The fundamental data were the

daily S&P 500 High, Low and Close Indices, Dow Jones Industrial

Average, Dow Jones Transportation Average, Dow Jones 20 Bond Average,

Dow Jones Utility Average and NYSE Total Volume from 1993 to 1996.

Three ANN-based forecasting models have been compared. The first

one used ANNs trained by historical data and their simple descendants.

The second one was trained by historical data and technical indicators,

while the third model used new features extracted by GP as well.

Plain ANN models did not provide the necessary generalization

power. The examined financial indicators showed interclass distance

measure (ICDM) values better than those of raw data and enhanced

the performance of ANN-based forecasting. By using GP much better

inputs for ANNs could be created improving their learning and

generalization abilities.

Nevertheless, further work on forecasting models is planned, for

example:

- extension of functions and terminals for GP

- direct application of GP for the extraction of investment decisions

- committee forecasts where some different forecasting systems work for the same problem and these forecasts are merged.

This project is partially supported by the Scientific Research

Fund OTKA, Hungary, Grant No. T023650.

Please contact:

László Monostori - SZTAKI

Tel: +36 1 466 5644

E-mail: laszlo.monostori@sztaki.hu