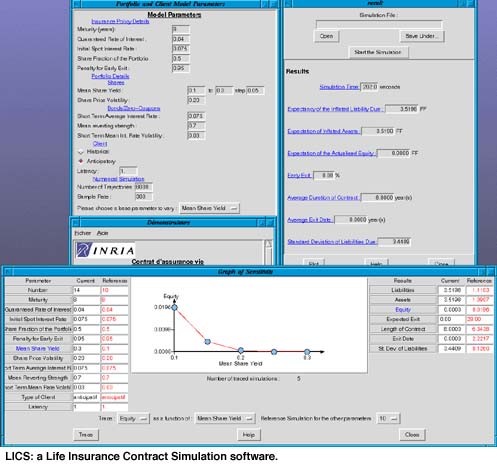

Life Insurance Contract Simulations

by Mireille Bossy

A common feature of life insurance contracts is the early exit

option which allows the policy holder to end the contract at any

time before its maturity (with a penalty). Because of this option,

usual methodologies fail to compute the value and the sensibility

of the debt of the Insurance Company towards its customers. Moreover,

it is now commonly admitted that an early exit option is a source

of risk in a volatile interest rates environment. The OMEGA Research

team at INRIA Sophia Antipolis studies risk management strategies

for life insurance contracts which guarantee a minimal rate of

return augmented by a participation to the financial benefits

of the Company.

A preliminary work of OMEGA consisted in studying the dependency

of the Insurance Company’s debt value towards a given customer

on various parameters such as the policy holder criterion of early

exit and the financial parameters of the Company investment portfolio.

Statistics of the value of the debt are obtained owing to a Monte

Carlo method and simulations of the random evolution of the Company’s

financial portfolio, the interest rates and of the behaviour of

a customer.

More precisely, the debt at the exit time t from the contract

(with an initial value of 1), is modeled by D(t) = p(t)[exp(r t) + max(0, A(t) - exp(r t))]. Here, r is the minimal rate of return guaranteed by the contract and

exp(r t) stands for the guaranteed minimal value of the contract at time

t. A(t) is the value of the assets of the Company invested in a financial

portfolio. A simplified model is A(t) = a S_t + b Z(t), where S(t) (respectively Z(t)) is the value of the stocks (respectively of the bonds) held by

the Company; a and b denote the proportions of the investments

in stocks and in bonds respectively. Finally, the function p(t) describes the penalty applied to the policy holder in the case

of an anticipated exit of the contract. Two kinds of exit criterions

are studied: the ‘historical’ customer chooses his exit time by

computing mean rates of return on the basis of the past of the

contract; the ‘anticipative’ customer applies a more complex rule

which takes the conditional expected returns of the contract into

account. In both cases, a latency parameter is introduced to represent

the customer’s rationality with respect to his exit criterion.

(The simulation of a large number of independent paths of the

processes S and Z permits to compute the different values of assets and liabilities

in terms of the parameters of the market, a, b, and the strategy

followed by the policy holder.)

In our first simulations, the asset of the Company was extremely

simplified: S(t) is the market price of a unique share (described by the Black

and Scholes paradigm) and Z(t) is the market price of a unique zero-coupon bond (derived from

the Vasicek model). Even in this framework, the computational

cost is high and we take advantage of the Monte Carlo procedure

to propose a software (named LICS) which attempts to demonstrate

the advantage of parallel computing in this field. This software

was achieved within the FINANCE activity of the ProHPC TTN of

HPCN.

The computational cost corresponding to more realistic models

can become huge. Starting in March 99, the AMAZONE project is

a part of the G.I.E. Dyade (BULL/INRIA). Its aim is to implement

LICS on the NEC SX-4/16 Vector/Parallel Supercomputer. This version

will include a large diversification of the financial portfolio

(around thousand lines) and an aggregation of a large number of

contracts mixing customers’ behaviors.

In parallel to this the OMEGA team studies the problem of the

optimal portfolio allocation in the context of simplified models

for life insurance contract. For more information, see:

http://www-sop.inria.fr/omega/finance/demonst.html

http://www.dyade.fr

Please contact:

Mireille Bossy - INRIA

Tel: +33 4 92 38 79 82

E-mail: Mireille.Bossy@sophia.inria.fr